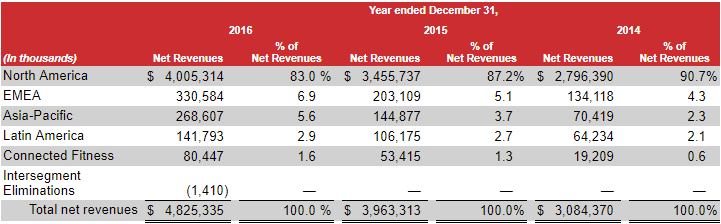

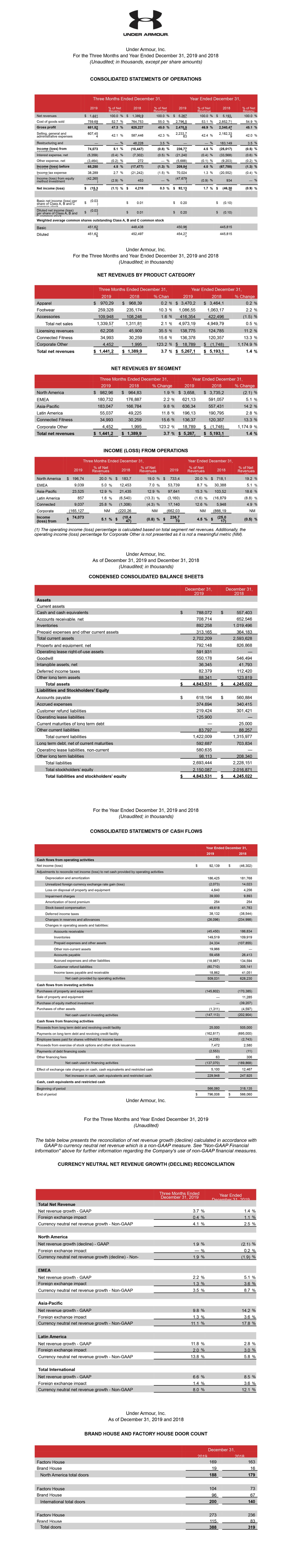

Under Armour Reports First Quarter Net Revenues Growth Of 36%; Raises Full Year 2014 Outlook | Under Armour, Inc.

![APPENDIX C - Under Armour and eBay Financial Statements - Build a Successful Business: The Entrepreneurship Collection (10 Items) [Book] APPENDIX C - Under Armour and eBay Financial Statements - Build a Successful Business: The Entrepreneurship Collection (10 Items) [Book]](https://www.oreilly.com/api/v2/epubs/9781633691964/files/01/images/e9781422131824_i0107.jpg)

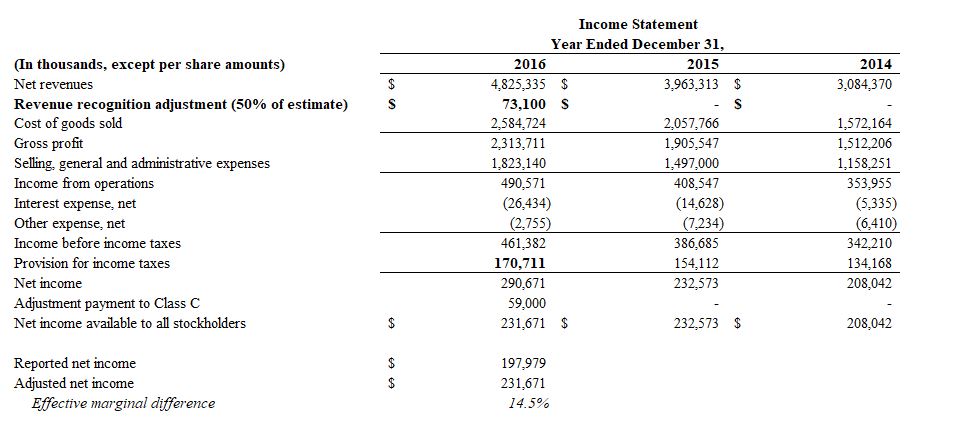

APPENDIX C - Under Armour and eBay Financial Statements - Build a Successful Business: The Entrepreneurship Collection (10 Items) [Book]

![APPENDIX C - Under Armour and eBay Financial Statements - Build a Successful Business: The Entrepreneurship Collection (10 Items) [Book] APPENDIX C - Under Armour and eBay Financial Statements - Build a Successful Business: The Entrepreneurship Collection (10 Items) [Book]](https://www.oreilly.com/api/v2/epubs/9781633691964/files/01/images/e9781422131824_i0108.jpg)

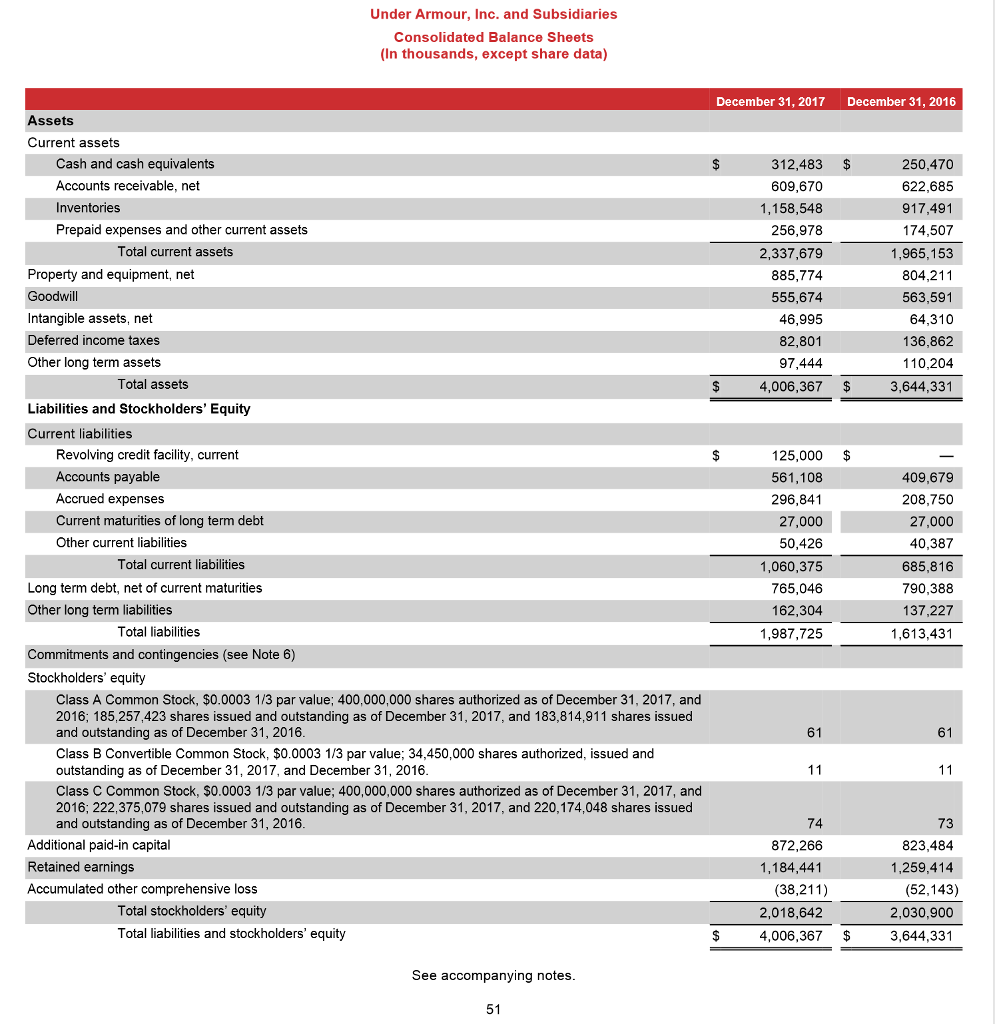

APPENDIX C - Under Armour and eBay Financial Statements - Build a Successful Business: The Entrepreneurship Collection (10 Items) [Book]

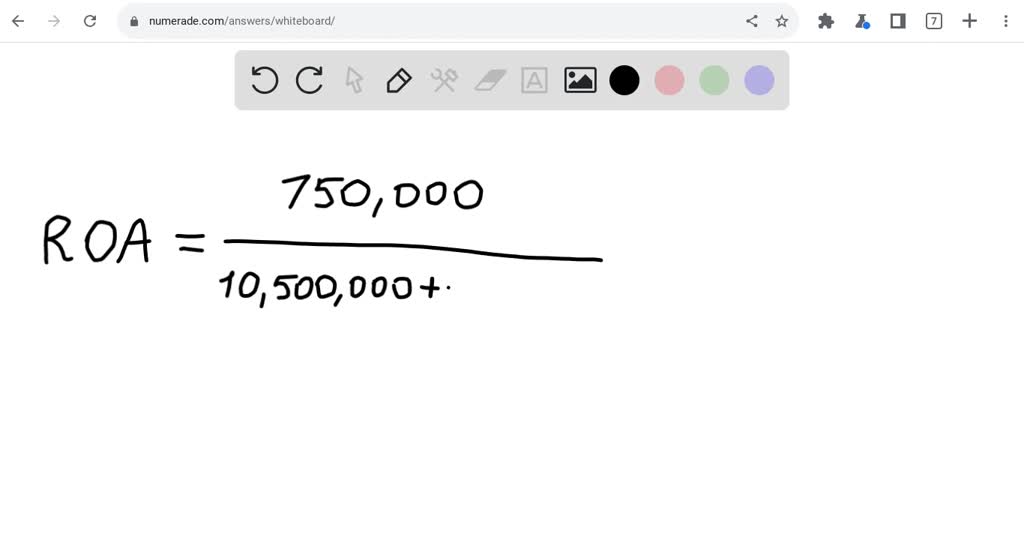

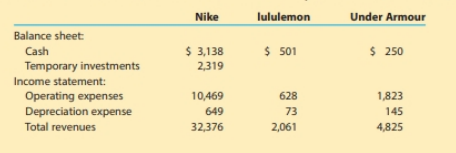

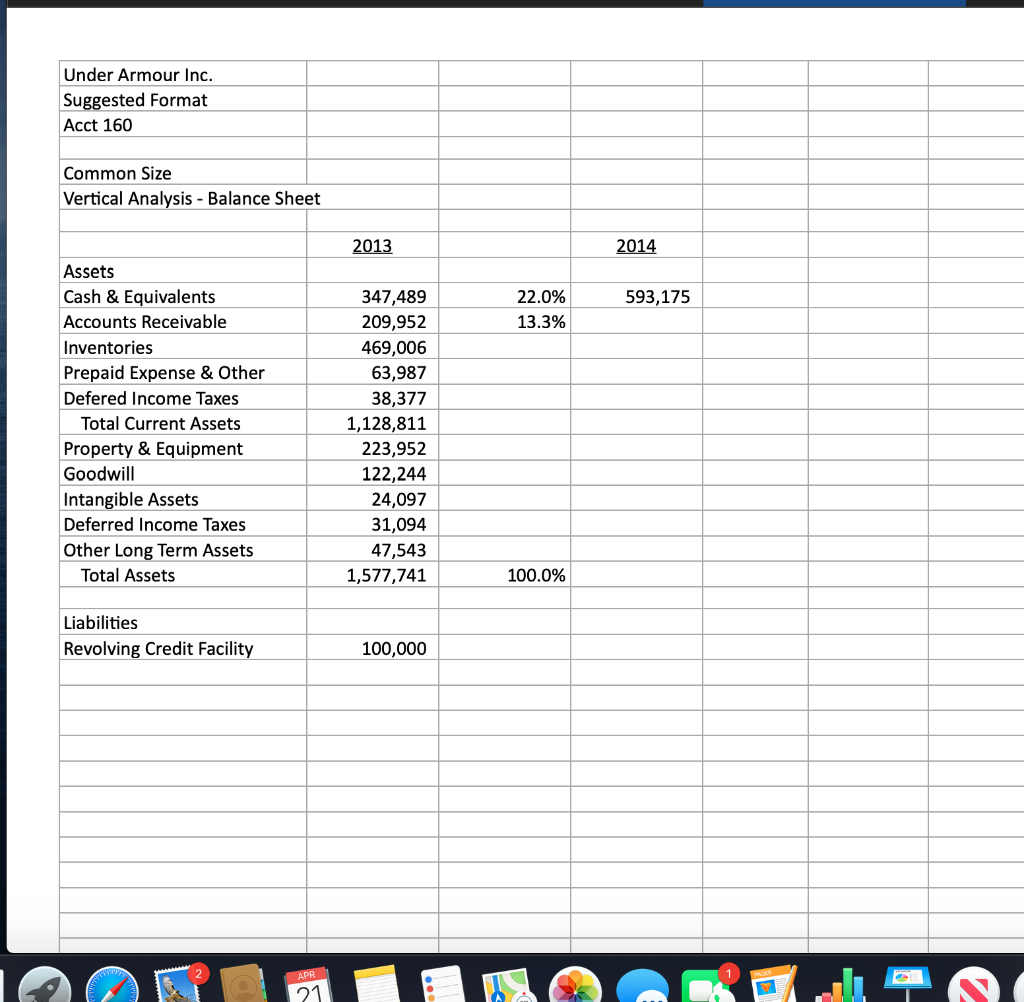

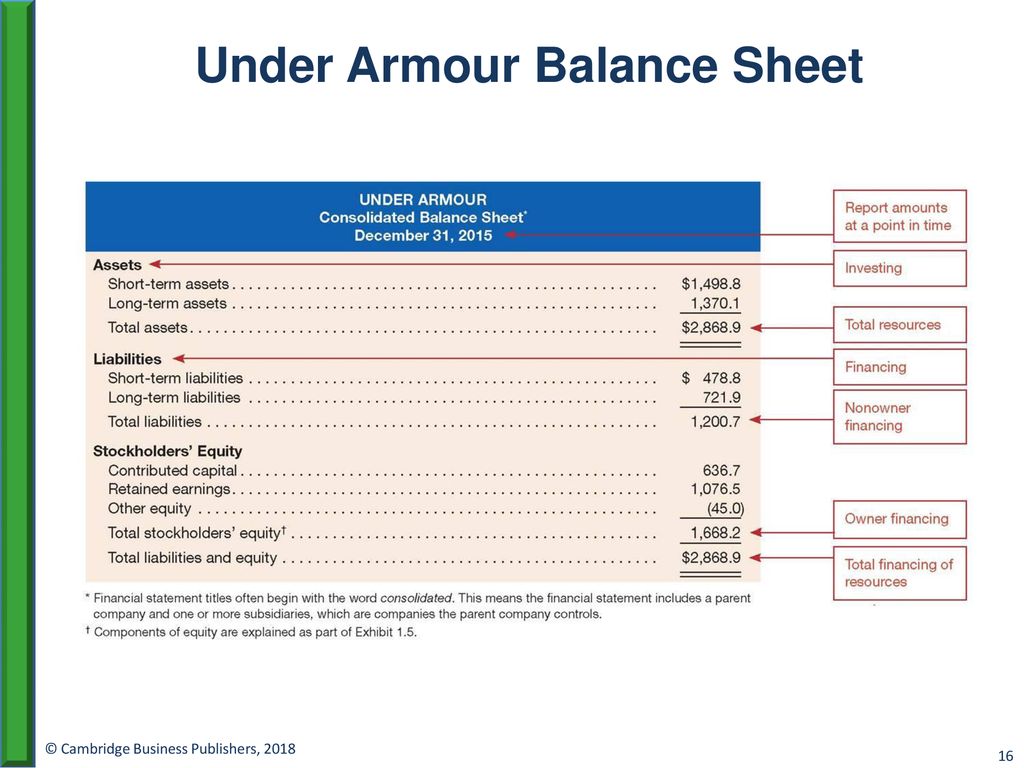

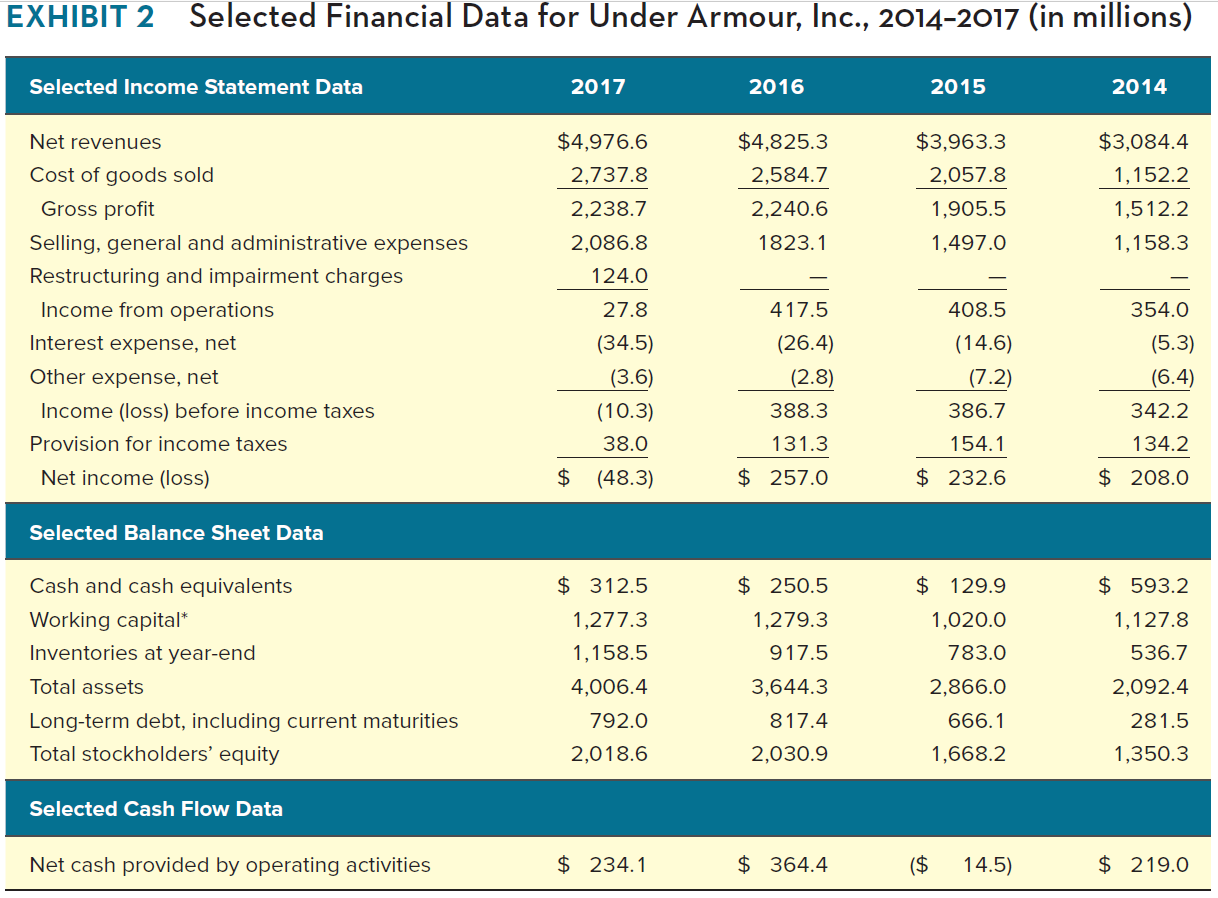

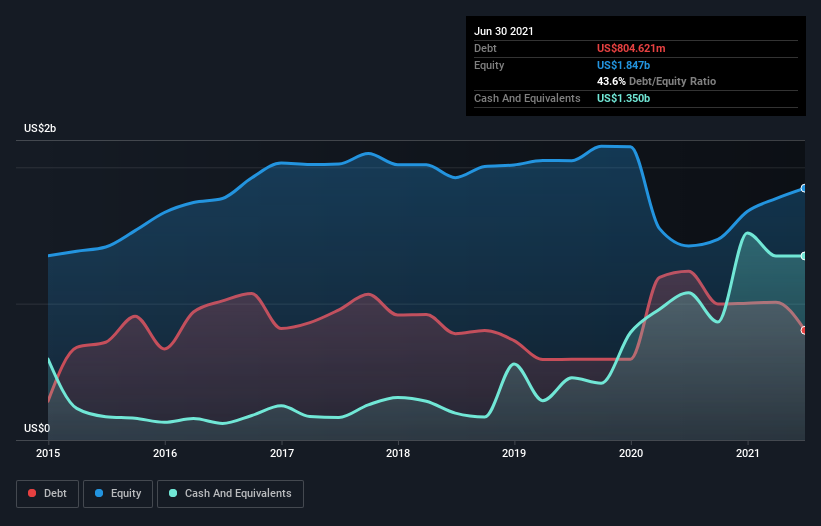

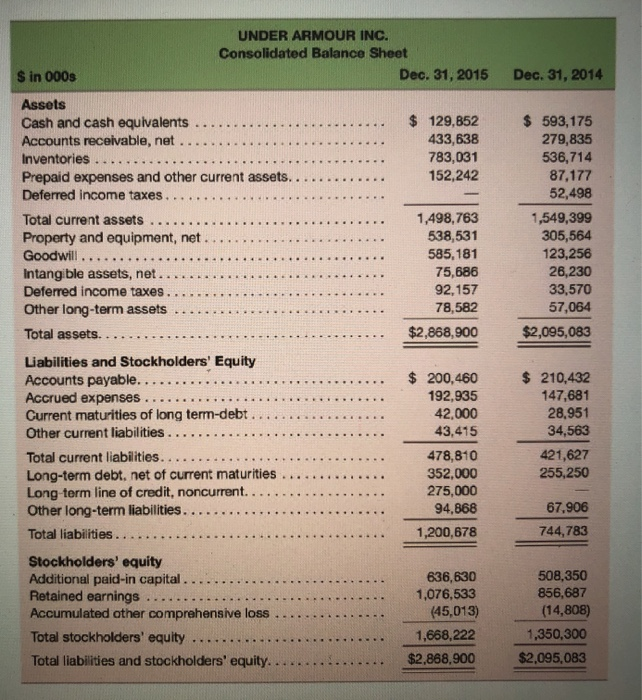

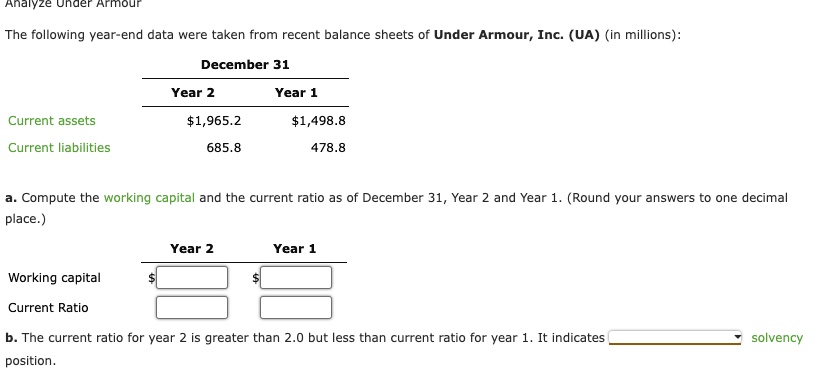

SOLVED: Analyze unaer Armour The following year-end data were taken from recent balance sheets of Under Armour, Inc.(UA) (in millions) December 31 Year 2 Year 1 Current assets 1,965.21,498.8 Current liabilities 685.8